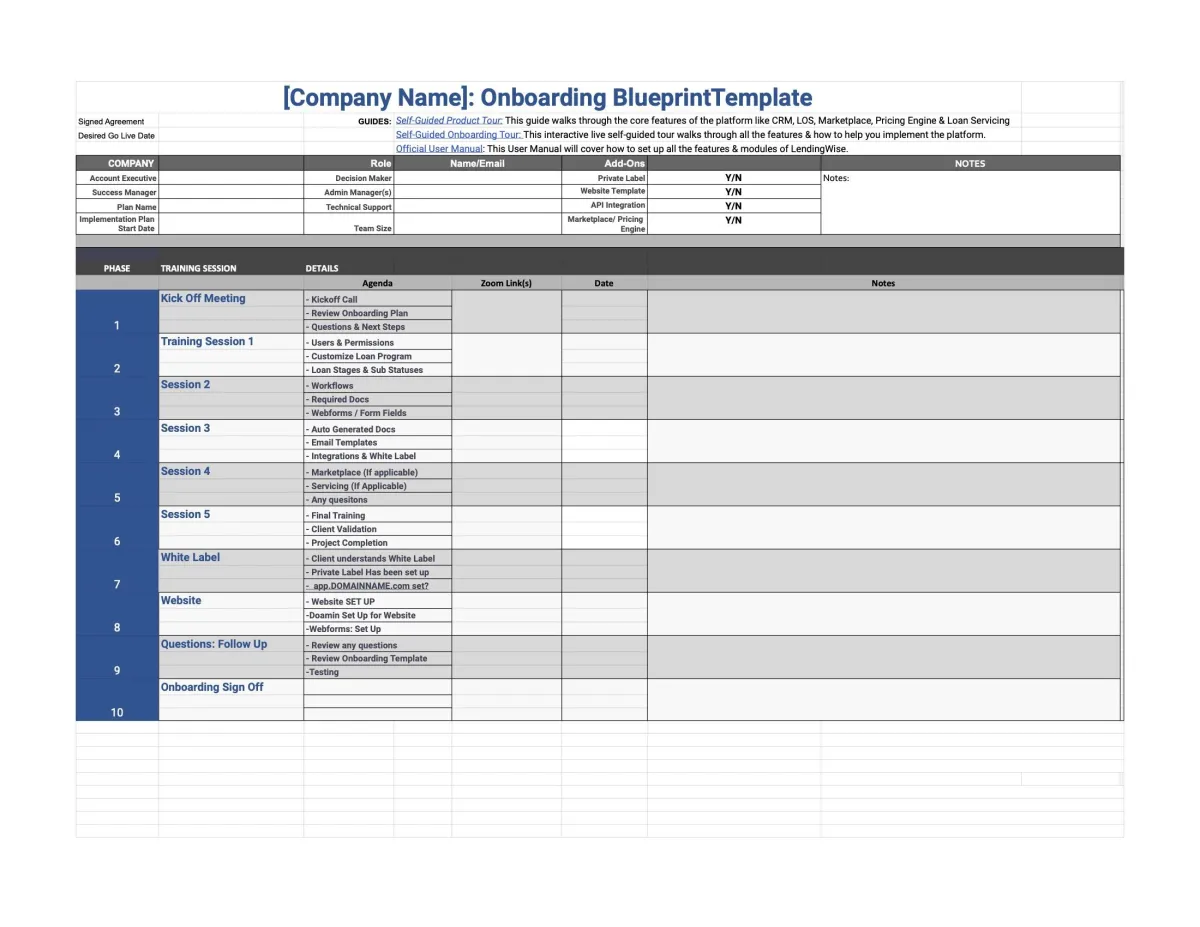

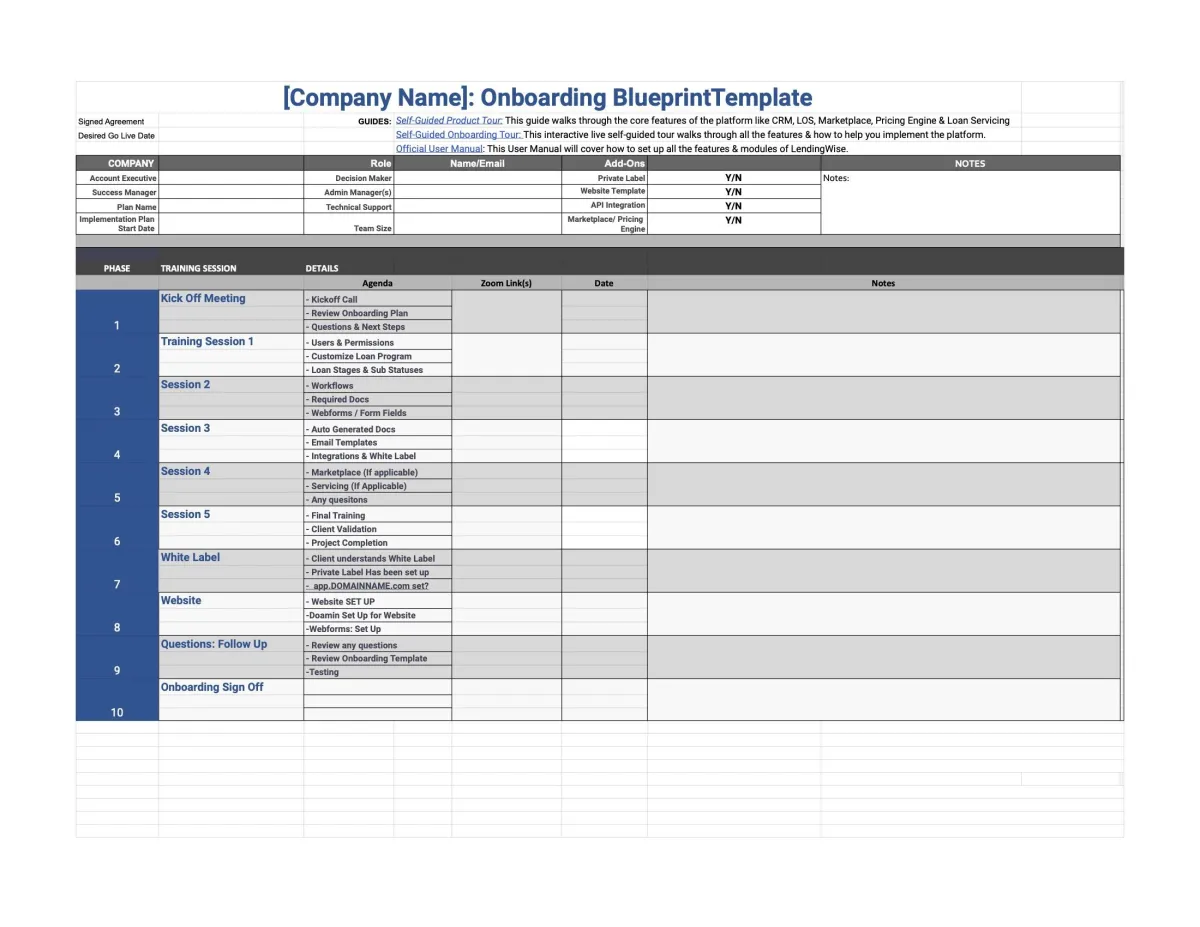

Master the Onboarding Process with a Step-by-Step Blueprint

This onboarding blueprint ensures a smooth and structured implementation of the LendingWise platform. With clear timelines, training sessions, and detailed instructions, your team will be equipped to fully utilize all platform features efficiently.

Begin with a Solid Foundation

Start by reviewing the onboarding plan and aligning your team with key roles, goals, and resources. This phase establishes the groundwork for successful onboarding.

1

Kickoff Meeting

Initiate the process with a kickoff call to review the onboarding plan, address questions, and set clear next steps.

2

Users, Permissions, and Loan Setup

Customize your platform by setting up user roles, permissions, and loan programs. This session also covers loan stages and sub-statuses.

3

Workflow Customization

Learn how to create workflows and manage required documents, webforms, and form fields to streamline your operations.

Advanced Platform Features and Customization

As you progress, dive deeper into the platform's advanced features, ensuring that your team is equipped with the tools they need for efficient operations.

$400B+

Residential Investor Loan Volume Annually in 2023

$21B+

Funded loans through our platform

>14 Days

Average days to close a loan & get paid

Lorem ipsum dolor

Lorem ipsum dolor

Lorem ipsum dolor

Final Training and Onboarding Sign-Off

Complete your onboarding with final validation, project completion, and a formal sign-off to ensure your team is ready to operate independently on the LendingWise platform.

What Do LendingWise Customers Think?

After trying several commercial lending & hard money lending systems, we have finally found the perfect CRM & LOS software platform to scale our growing business. They have numerous robust features, it’s very customizable, and they are always willing to work with our unique requirements. It’s been amazing!

Whit McCarthy

CEO | Consistent Capital

LendingWise has been an invaluable CRM & LOS software platform to help us manage our borrowers, broker network and ever growing private money deal flow. They make our intake, processing, underwriting & loan closing process extremely efficient, which helps us continually grow and scale our hard money lending business!

Jeff Fechter

CEO | HouseMax Funding

After trying several commercial lending & hard money lending systems, we have finally found the perfect CRM & LOS software platform to scale our growing business. They have numerous robust features, it’s very customizable, and they are always willing to work with our unique requirements. It’s been amazing!

Matt Flores

EVP | CV3 Financial

Our Happy Clients:

Copywright © 2024 LendingWise. All Rights Reserved